Our Products

Trading Models

Courses

Analysis & Data

Articles

How To Use Technical Analysis With Binary Options

Technical analysis is traditionally used to analyze and predict the price direction of stocks, commodities, forex pairs, indexes and other "underlying" assets. But technical analysis can be combined with binary options to develop several unique trading strategies...

1-Day vs. 2-Day Breakouts – Which is Better?

One of the big questions when developing a breakout trading system is "how do you define a 'breakout'?" Defining a breakout usually comes down to four criteria: What is the look-back period? What high (or low) price do you use to define the breakout level? How far...

Breakout or BLOWOUT?

When trading price breakouts, the second worst thing that can happen is getting caught in a bull or bear trap. Instead of following through with the initial move, price quickly reverses and reenters the price range from which it just escaped. If you're smart you...

Is Your Market Breakout Friendly?

Breakout trading strategies are some of the best systems for generating significant capital gains. However, breakout systems pose a particular challenge that can chew up your account equity quickly: Is this price move really a breakout? If you can't answer this...

Anatomy of a Successful Trend Trade with Excel (Case Study)

A few years ago I made a $1,000 trade in Advance Emissions Solutions (a clean coal company NASDAQ: ADES) for around $5 per share. After two years and 3 long trades, ADES topped out at over $28 per share. The net profit on my long trades was over $16,000 on that...

Become An Idiot-Proof Trader: Excel Versus Trading Software

I get this question all the time. "I use Trading Software X and it has all the bells and whistles. Does your Excel software do what Software X does? I just want to make money." [signed, Trader Losing Money] You know my answer? "It's not the software." I've used the...

Determining the “Trendiness” of a Market Using Excel

If you are a trend trader your best profits will come by trading markets and securities that have a tendency to move in strong price trends. A key goal then is determining the "expected trend strength" or "trendiness" of a security. You must usually wait until a...

Trading the Trend for Big Profits With Excel

The foundation of a great trading system is the ability to identify and capture large price moves. A system that consistently generates large winning trades can easily offset smaller losing trades and produce significant profits. This is the main feature of trend...

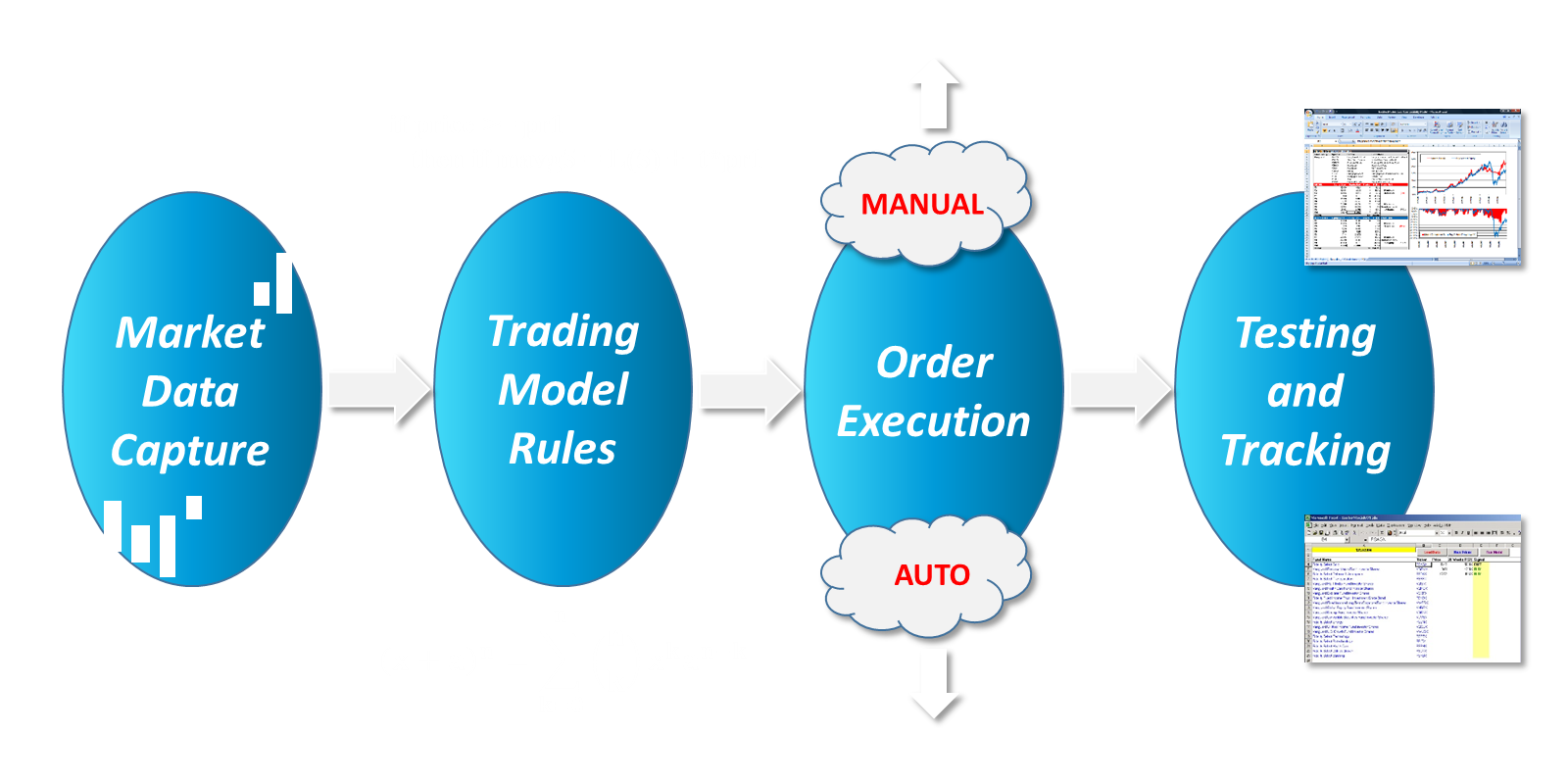

Your First Trading Model in Excel

I get this question a lot: "If you were going to design your first trading model in Excel, what system would you start with?" The answer has a lot to do with what you trade and what you consider "trading". Are you a stock trader or a foreign currency trader? Do you...

FAQ: The VBA code Sheets(ticker).Select is highlighted. What do I do?

The code isn’t broken. The error you’re getting can mean one of 4 things: 1/ you did not save the .csv files you downloaded with TICKER.csv in ALLCAPS (replace TICKER with your desired symbols) 2/ your list of ticker symbols in the Controls worksheet are not in...