Technical analysis is traditionally used to analyze and predict the price direction of stocks, commodities, forex pairs, indexes and other “underlying” assets. But technical analysis can be combined with binary options to develop several unique trading strategies that generate unique profit curves.

Which Binary Options Are We Talking About?

First off, in this article we will only discuss NADEX binary options. NADEX options trade between $0 and $100 in value and allow you to select a strike price. They’re also legal and regulated in the USA. Finally, you trade directly on the exchange, as opposed to having a broker (or two) in the middle. This makes trading somewhat faster and less susceptible to front-running and broker failure. NOTE: The CBOE also has binaries on the VIX (BVZ) and S&P 500 (BSZ).

How To Use Technical Analysis With Binary Options

The first step is to decide which binary option frequency to trade. Daily and Weekly NADEX binary options are much more suited to technical analysis-based trading strategies than the hourly maturities. Technical analysis-based trading systems are designed to predict price direction, which is much easier on longer time frames. Intraday binary option models are essentially statistical gambling systems relying on time and implied volatility inputs for theoretical pricing.

The second step is to decide whether you want to trade Out of the Money (OTM), At the Money (ATM) or In the Money (ITM) binary options. Let’s look at these approaches:

- OTM: Option prices are cheaper (< $50 usually), lower probability of being in the money at expiration, lower liquidity, higher potential payoff, higher potential loss, rapid price appreciation in a short period of time as underlying price approaches strike price, high sensitivity to volatility change and time to expiration. All value of the option is time value, with no intrinsic value.

- ATM: Option prices hover around $50, roughly 50/50 chance of being in the money at expiration, high liquidity, medium potential payoff, medium potential loss, rapid price appreciation in a short period of time as underlying price approaches strike price, high sensitivity to volatility change and time to expiration. All value of the option is time value, with no intrinsic value.

- ITM: Option prices are more expensive ( > $50, higher probability of being in the money at expiration, high liquidity, lower potential payoff, lower potential loss, price does not fluctuate much unless the underlying price comes close to the strike price. 50% of the value of the option is time value, the rest is intrinsic value.

If you’re new to binary options, it’s best to stick with ATM or ITM options. ITM options in particular give you much more leeway to make minor mistakes and still generate a profit or small loss. Their prices move much slower so they tend to be more forgiving to trade. They’re also pretty liquid compared to OTM options.

The next step is to select your underlying asset:

- Stock Index

- Forex pair

- Commodity

Next, you need an effective technical analysis trading strategy to trigger your binary option trade decisions.

The main feature you want in your technical analysis trading strategy is a high win rate. Ideally, 65%+ of your trades should be winners across a large sample of historical price data, including in- and out-of-sample and walk forward testing. This high win rate is required to offset the bid-ask spreads in binary options, which can be 10% at times, plus the $0.90 trade fee from NADEX.

The reason we’re looking for a high trade win rate is because binary options have a fixed payout.A high trade win rate means you can accumulate many small profits and generate a solid equity curve using technical analysis to trade binary options.

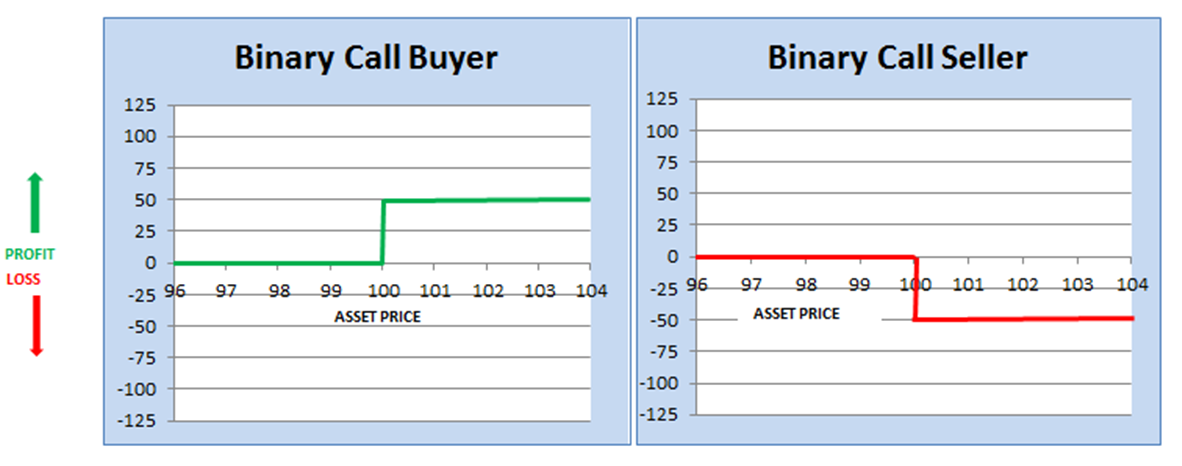

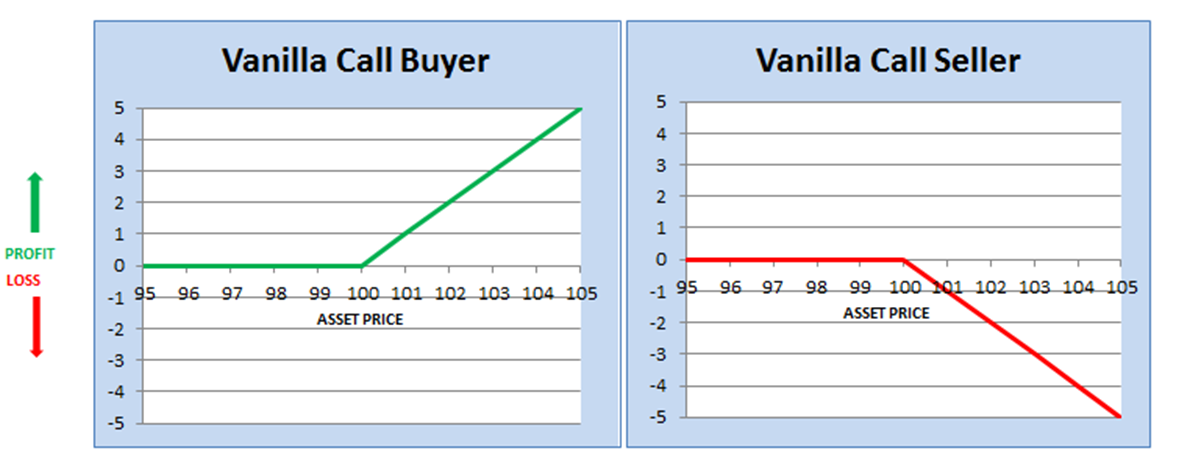

Here’s why you need a high win rate: If you pay $50 and your binary option ends in the money you get $100 – $50 = $50 in profit. You will get $50 in profit regardless of how far past the strike price the underlying price has gone. Compare that to a long vanilla option position where you can earn theoretically unlimited profits if the underlying price blows through the strike price by a wide margin. These 2 payoff charts show the fundamental difference between a binary option payoff and vanilla option payoff. Basically, the binary option will have a much lower payout, so you need a higher frequency of winning trades.

Binary Option Payoff

Vanilla Option Payoff

The next feature you want in your trading strategy is a fairly high trade frequency (3-5 trade signals per week ideally). If your system looks for patterns that appear only once a month, you won’t generate enough trades for binary options to be profitable without scaling up the size of your trades. Long term trend and breakout trading strategies (which typically have low win rates but high profit per winning trade) are not suited to binary option trading unless you are an option seller looking to profit from the loss of time value.

Examples of high win rate trading systems include:

- Mean Reversion

- Gap Filler

- Pivot Point

- Daily Range

- Chart Patterns (candlesticks, etc.)

- Fibonacci Reversals

Trade Mechanics

Without getting deeply into programming custom trading systems in Java or C#, you can use a trading model built in Excel, combined with a manual selection and trading process for the binary option. If you trade In-the-Money (ITM) options it gets easier because they don’t move as quickly.

The great thing about binaries is their limited loss. This reduces the need for stop loss management, because you know exactly how much you can lose at the moment you trade the option. You may choose to exit losing trades early, or let them run to expiration.

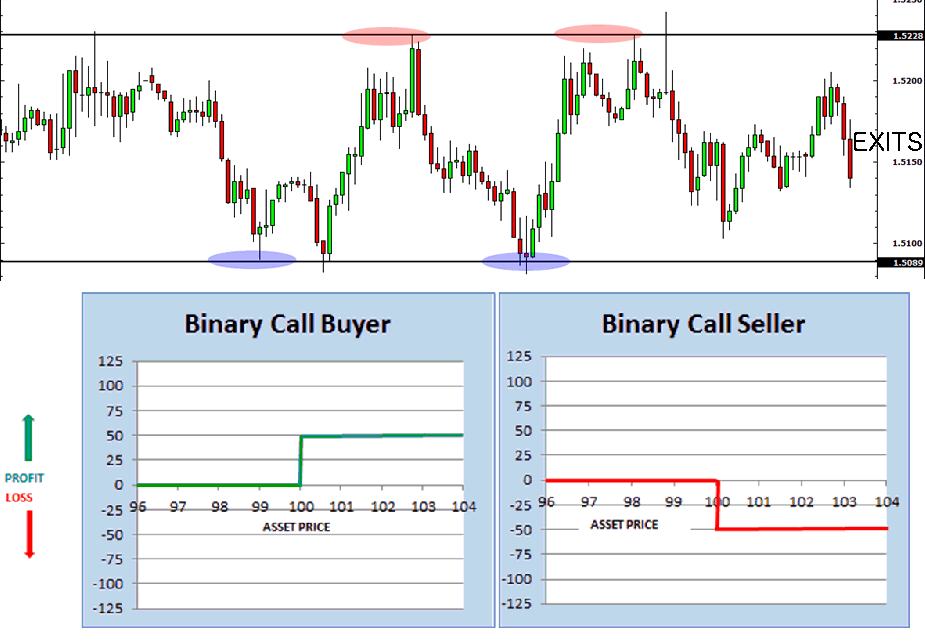

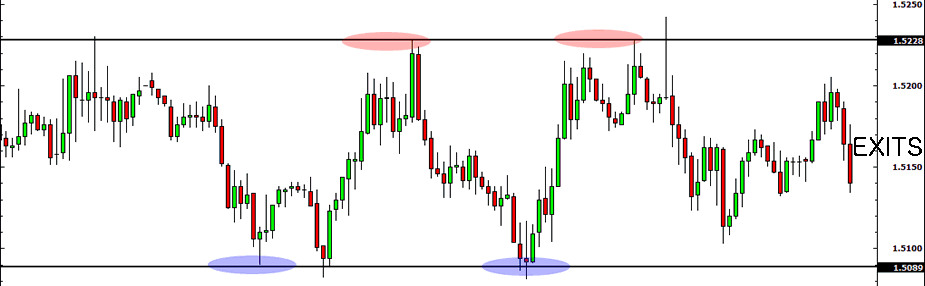

Let’s say you trade the EURUSD binaries and use a Daily Range strategy, buying near the daily low and selling near the daily high throughout the day. Let’s assume you trade daily contracts that have a strike near the middle of the day’s range.

Let’s say you were able to buy 2 daily options with a strike price of 1.5150 when the price dipped to 1.51 (OTM). You were also able to sell 2 daily options with a strike price of 1.5150 when the price rose to 1.5225 (OTM).

Assuming you held the 4 options to expiration at 4:15 PM that day, you would earn something like this:

- Buy Option #1 @ 1.51 for $32

- Sell Option #2 @ 1.5225 for $41.50

- Buy Option #3 @ 1.51 for $37

- Sell Option #4 @ 1.5225 for $28.50

Daily P&L for these trades:

- Option #1: $100 – $32 = $68

- Option #2: $100 – $41.50 = $58.50

- Option #3: $100 – $37 = $63

- Option #4: $100 – $28.50 = $71.50

The total risk was $139 to earn $261, for a reward-to-risk ratio of 1.88.

Binary options can offer some interesting and potentially lucrative trading opportunities when combined with technical analysis-based trading models.