Articles

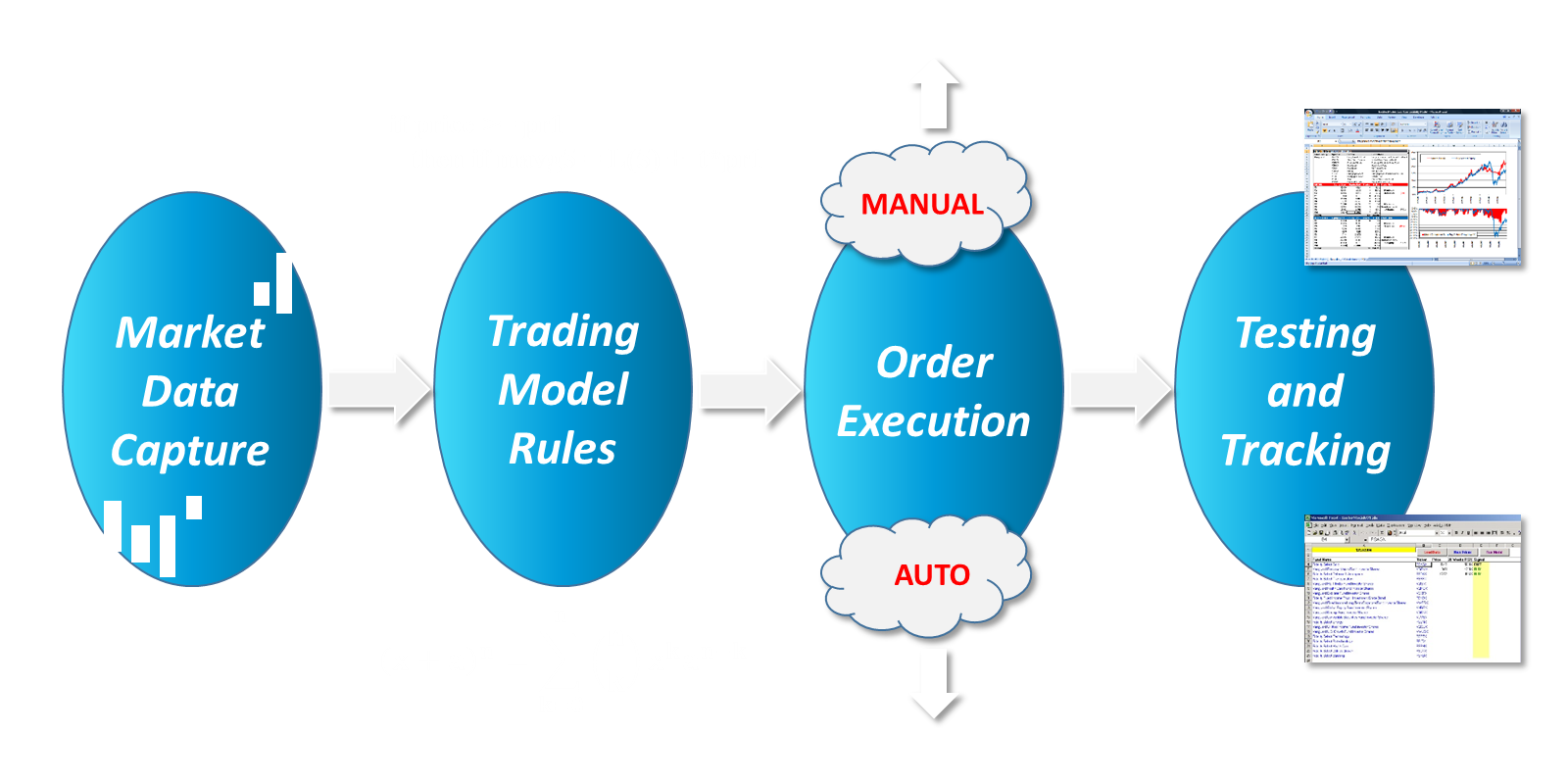

Manually Entering Trade Orders from an Trading Excel Model

Once you have your trading rules set up and you have coded them to display in your Excel trading model spreadsheet, you can simply enter the orders manually with your broker. This is the simplest and most reliable method, and works well when you only need to send a...

Steps for Developing Your Trading Model Logic

The following basic steps should be taken in developing your trading rules. The best way to do this is to write it down as you go. You will undoubtedly change your rules, find errors, and develop rules for the many complicated situations you come across in the...

Basics of Trading Model Rules Development

Trading model rules are based on IF-THEN statements, Variables, Loops, and Arrays. If-Then StatementsAn IF-THEN statement is a way of conditionally evaluating inputs against pre-set criteria or rules. It is based on sequential linear logic, which is the way...

Building an Excel Trading Model Using a Hybrid Approach

You can often get the best of both worlds by buying or developing an add-in toolkit and combining it with custom formulas and VBA. This allows you to focus on the parts of your model that are specific to your needs while gaining efficiency and functionality in those...

FAQ: Can I backtest more or less than 10 funds at a time?

You cannot use more than 10 funds at a time in the backtest model. The backtest model only has sufficient room in columns B through K of the Calculations sheet for 10 funds. You CAN backtest fewer than 10 funds. You will need to make sure the weekly closing price data...

FAQ: I sorted the tickers in descending order and then pasted them into the backtesting model using 27 months of weekly data, but it won’t show the results or graph.

There are 3 possible solutions: 1) Make sure you have closing prices for each fund filled in all the way down to row 576 in the backtesting model Calculations worksheet columns B thru K. 2) Check for any NULL, blanks, or zeros (0) in the price data. Scroll down...

FAQ: With Yahoo Finance price data, do I use the ‘Close’ or ‘Adjusted Price’?

Use the Adjusted Price instead of Close price with Yahoo Finance data. Adjusted Price includes splits and dividends in the historical prices so you don't get jumps in the data.

FAQ: Can the formulas be modified to use different length moving averages?

Yes, you can modify the moving average lengths or any other parameter. Just modify the formulas in the Calculations worksheet and make sure the backtest worksheet parameters are set exactly the same. Of course, the model is likely to behave differently. Backtesting...

FAQ: I have run the model and there are funds at the top with the greatest relative strength, but no Buy signals at all. What do I do?

You may end up with several funds at the top of the relative strength list and no BUY signals at all. This is a signal to put your money in the safest spot you can (cash). With no BUY signals and no upside opportunity, it's time to sit and wait for the next major...

FAQ: I wanted to use this model in a 401K account. I am limited to 20 funds and have entered all of them and data into the model. Two of the funds that I am in right now are doing well but not in the Buy top 3, so I’m hesitant to exit them at this point – maybe a mistake. Should I move my money right away into the funds with Buy signals?

We're not investment advisors, so can't give specific buy/sell recommendations. However, we do suggest SLOWLY rotating your current fund selection into new funds as you start to see new BUY signals in the top 3. If you don't see new BUY signals, then you should...