The next step is to plan how you are going to execute trade orders in the market from your Excel trading model’s signals.

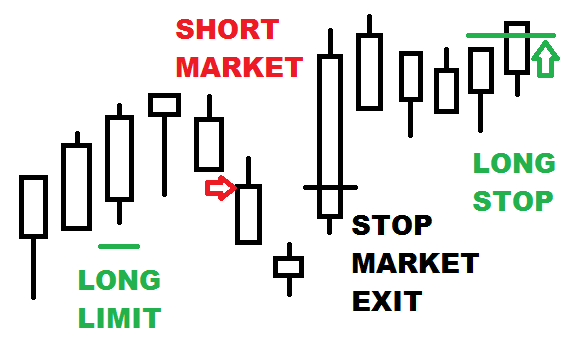

Trade execution is often misunderstood because there are many different types of trade orders. For example:

- Market

- Limit

- Stop

- Stop Limit

- All-or-None (AON)

- Good ‘Till Cancelled (GTC)

- Immediate or Cancel (IOC)

- Fill and Kill (FIK)

- Fill or Kill (FOK)

- …and more

The order type you choose to enter and exit your trades will have a substantial effect on the real life performance of your trading model.

Your first Excel trading model should be designed with market orders in mind. The reason is that market orders have a higher probability of actually being executed at or near the published opening price of a price bar. This means you can back test your model using published market data and get accurate results. The other order types have less probability of execution and require tick level data to back test.

You should also think about the timing of order entry. Should you buy immediately? Right before the close of a bar? At the next’s bar’s open? Should your orders always have the same time delay, like overnight, or should you execute them differently depending on the day of week (e.g. no holding over a weekend). Most basic trading models buy or sell at the open of the next bar. Other order types can be tested to see if they lead to greater profits or losses.

Now that you’ve decided on the type of trade orders your model will generate, it’s time to move on to Step 8 >