The second step in building a trading model in Excel is to write down the rules for your trading strategy.

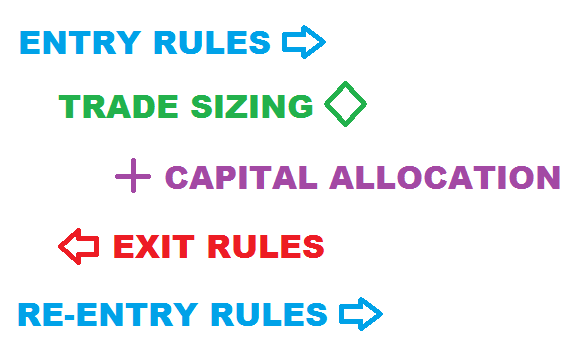

Your trading strategy rules should include:

- When you should buy, sell or stay out of a position

- What assets to trade

- Whether you will go long or short, or both

- How much capital to allocate to each trade or position

- The specific rule triggers to enter a trade

- The specific rule triggers to exit a trade

- Whether the strategy allows position reversals from Long to Short or vice versa (aka “stop and reverse”), or if an exit from the first trade is required before entering a new trade in the opposite direction (aka “stop, exit, reverse”)

- How much leverage to use, if any

- What time frame to trade (1 minute, hourly, daily, weekly, etc.)

- How price inputs are defined (OHLC bars, tick charts, Renko boxes, etc.)

- Whether you will hold overnight positions or day trade only

- What market data will be used, for example the closing price or open-high-low-close

- Whether the strategy is entirely price-based or if other data is required, such as volume, economic indicators, Twitter feeds, weather data or other inputs

- How frequently you want to trade e.g. every 5 minutes, every few hours, daily, every 3-5 days, every other week or once a quarter?

- Whether a position will be taken and held without adding or subtracting capital, or if positions will be scaled in or out

- How simple or complex the strategy will be

…and many other factors.

Once you decide how your strategy rules and conditions will operate, you must then write them down. The best format this is to use “if-then-and” statements. For example:

ENTRY RULE:

IF closing price is above the 50 day moving average of closing prices, THEN:

IF RSI rises from below 30 to above 30, AND this quarter’s GDP growth is above last quarter’s GDP growth, THEN

ACTION: Buy the S&P500 index ETF using 50% of my available equity.

Likewise, you will need to devise similar exit rules and write them down.

Using these written rules, you can then proceed to Step 3 >