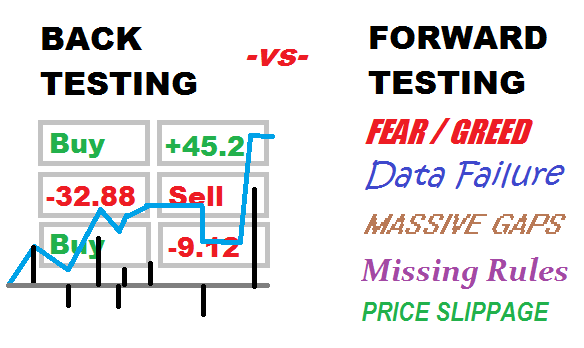

A common error is to finish back testing your trading model then immediately jump into live trading full size positions. HUGE MISTAKE!

After you are done testing your Excel model on historical data, the next step is to trade it live in the markets in “walk forward testing” mode.

There are four goals during the forward testing phase:

First, trade very minimal size. The number of shares or units you trade should be one-tenth or even less of your intended trade size. Why? Because it is cheap testing while giving your model real life experience. If you go to big at this stage before you work out all the bugs in your trading model, you are invariably going to face a big loss at some point. Keep it small and keep your capital.

Second, look for real world errors or gaps in your Excel trading system logic. Don’t have a rule for exiting when the market gaps down? Does your model generate too many consecutive trades at certain times? Need another indicator to filter out choppy prices that slice up your trade equity? Have an unexpectedly long string of losing trades? Running your model in a live market will find these issues quickly. Do not be surprised if you end up modifying your first model a few times as a result.

Third, understand what your model does in unexpected market conditions. During the design period you can develop rules to handle hundreds of different market permutations, but even the most experienced developers cannot anticipate the unknowable. It is very difficult to accurately estimate the effect of a failed order entry or exit, how much your model loses when your Internet connection goes down, or a sudden market shock that sends your P&L into a tailspin. Price slippage can also be significantly higher during low volume / high volatility periods. This will have a natural drag on your model’s profits that you need to discover and address.

Fourth, test how easy your Excel trading model is to follow. The #1 reason for trading model failure is user failure. This means failing to obey the trading signals after you made the effort to design, build and test your model properly. You are not only testing the trading model logic, you are testing your relationship with the model. Your discipline and ability to reliably execute the model’s signals is critical. If you start disobeying trading signals during a long draw down period, then you will not be able to stay with it long enough to catch the large profitable moves.

We do not advise “paper trading” your model. This doesn’t actually test anything except your ability to record theoretical entry and exit prices. Without any emotional involvement or market stress, paper trading a model is not testing at all. Don’t paper trade — forward test.

Once you have successfully forward tested your Excel trading model in the market, it is time for Step 10 >